Cancer, Stroke, Heart Attack Plan

Will you be able to afford the treatment if you or your family member are diagnosed with cancer?

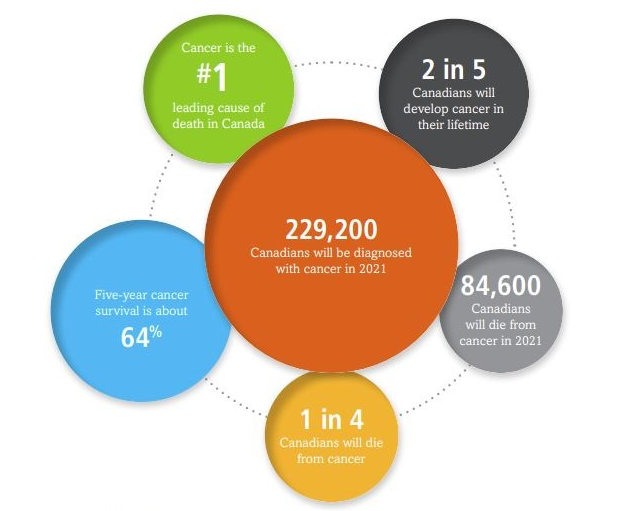

Nearly two in five Canadians will receive a diagnosis of cancer in their lifetime according to the Canadian Cancer Society. The good news is medical treatments allow people to survive cancer however treatment and recovery could be costly. Being diagnosed with a cancer cause a negative impact in your financial and lifestyle to you and your family.

Do you have a plan?

It’s important to know that company health insurance plans might not cover all your healthcare needs. The unexpected out-of-pocket expenses of cancer recovery, such as transportation or chemotherapy can create a financial burden as you must cover your non-medical expenses such as mortgage, child care or monthly bills in the same time. Our Cancer insurance plan provides you financial stability. You can use money to cover lost income, cost of medication or treatment, so you can focus on recovery.

Cancer can impact anyone At any time in an unexpected way.

will you be able to afford to maintain your current lifestyle?

Our Cancer care plan provides you daily cash benefits.

Heart disease is the 2nd leading cause of death in Canada

People are having more heart attacks

Rising by 2 percent each year for the last 10 years

Financial Support

Our plan provides you financial support during treatment and recovery

Resources

© 2022 Axiom-FrontLine Financial Services. All Rights Reserved.